Apple Savings Account: Your One-Stop Solution for Smart Savings!

Snehil

- 0

Apple has been one of the most successful companies in consumer tech. Rightly so, whichever niche it targets, it does it better than others. For the first time, Apple is issuing a savings account directly on to your iPhones, for which you don’t even need to visit the bank. It comes with a beautiful interface and high interest rate. I have been following the story for a week now and here are my insights and a full review of Apple Savings Account.

Table of Contents

What is Apple Savings Account?

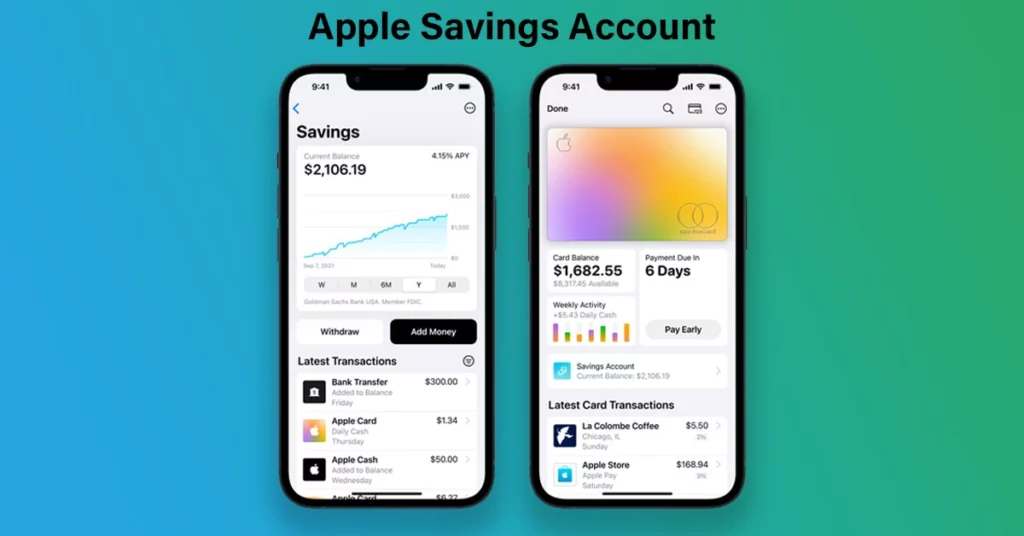

Apple has forayed into the banking sector with a collaboration with Goldman Sachs. Currently, if you are a US citizen, you can get an Apple Savings Account without even visiting the bank. With no fees, no minimum deposits, and no minimum balance requirements, it’s easy to set up and manage your Savings account directly from Apple Card in Wallet. Once you’ve set up your account, all future Daily Cash rewards earned on your Apple Card will be automatically deposited into your Savings account, allowing you to grow your savings effortlessly.

In addition to automatic deposits, you can also deposit additional funds into your Savings account through a linked bank account or your Apple Cash balance. And if you ever need to withdraw your funds, you can do so at any time through the Savings Dashboard in Wallet, with no fees or penalties.

But the benefits don’t stop there. As an Apple Card user, you already enjoy Daily Cash rewards on every purchase, with no annual fees. The refined app interface and tools from Apple leave other banking apps far behind, helping you manage your expenses efficiently and you pay less interest on your card balance. And now, with the new high-yield savings account from Goldman Sachs, you can further enhance your financial health and savings, all while enjoying the privacy and security you expect from Apple.

To take advantage of this exciting new feature, simply update your Apple Card in Wallet and follow the easy steps to set up your Savings account. With a high-yield APY and no fees or requirements, it’s a no-brainer for Apple Card users who want to get more out of their Daily Cash rewards and build their savings effortlessly.

Apple Savings Account Interest Rate

The interest rate offered by the Apple Card Savings account is one of the main draws of this new feature. With an APY of 4.15 percent, users can earn more than 10 times the national average on their savings. This high-yield rate is made possible through a partnership with Goldman Sachs, a well-known financial institution. By depositing your Daily Cash rewards into your Savings account, you can watch your money grow over time without having to do anything extra. And with no fees, minimum deposit requirements, or minimum balance requirements, it’s easy for anyone to get started and start earning interest right away.

But what sets the Apple Card Savings account apart from other high-yield savings accounts is its integration with the Apple Card and Wallet app. You can manage your Savings account directly from the app, making it easy to track your balance, interest earned, and transactions. You can also easily deposit additional funds from your linked bank account or Apple Cash balance. And if you ever need to withdraw their money, you can do so at any time without any fees.

What Do You Need to Open an Apple Savings Account?

- Must have an active Apple Card account added to iPhone

- Must be at least 18 years of age

- Must possess a valid Social Security number or individual taxpayer identification number

- Must be a U.S. resident with a physical address that can be verified

- Must set up two-factor authentication for the Apple ID

- Must ensure that the latest version of iOS is installed – iOS 16.4 or later

Apple High Yield Savings How To Open?

Opening an Apple high yield savings account is a straightforward process that can be completed entirely from your iPhone. To get started, you need to have an Apple Card account, as the savings account is an extension of the card’s features. Once you have an Apple Card account, open the Wallet app on your iPhone and select the Apple Card. From there, tap on the “…” button in the top-right corner of the screen and select “Add Account.”

Next, you’ll be prompted to review the terms and conditions of the savings account, including the interest rate and any fees associated with the account. If you agree to the terms, tap on “Continue” to proceed. You will then need to verify your identity by providing your name, address, and Social Security number.

Once your identity has been verified, you will be prompted to create a username and password for your Goldman Sachs account. Once you’ve set up your account, you can link it to your Apple Card and start earning a high yield on your Daily Cash rewards. There are no minimum balance requirements or fees associated with the account, and you can deposit additional funds into your savings account at any time through a linked bank account or your Apple Cash balance.

In the event that your Apple Card account is restricted or locked, you may encounter difficulties when attempting to open a Savings account. Similarly, if your Apple Cash or Savings account is restricted or locked, you may not have the ability to transfer funds to or from Savings.

Is Apple Savings Account FDIC Insured?

The Apple Savings account is FDIC-insured, which means that the funds deposited into the account are backed by the full faith and credit of the US government, up to a maximum of $250,000 per depositor, per insured bank. This ensures that the money you put into your Apple Savings account is protected in the event of a bank failure or other financial instability. With no minimum balance requirements and no fees, it’s easy to start saving with the Apple Savings account.

Apple Savings Account Maximum Balance

As for the maximum balance, there is no specific limit on how much you can deposit into your Apple Savings account. However, keep in mind that the FDIC insurance coverage is limited to $250,000 per depositor, per insured bank. So, if you have more than $250,000 to save, it’s important to spread your deposits across multiple banks to ensure that your funds remain fully insured.

Apple Card Benefits for Mastercard users

Zero Liability Protection: Apple Card customers are not responsible for unauthorized purchases made with their card, whether in-store, over the phone, or online. This benefit is provided through Mastercard’s Zero Liability program.

Mastercard ID Theft Protection: You can enroll in Mastercard’s ID Theft Protection service, which monitors their credit file for fraud, sends alert notifications about suspicious activity, and provides assistance from a resolution specialist.

ShopRunner: Enjoy a free membership to ShopRunner, which offers free two-day shipping and free returns at many popular stores, including Bloomingdale’s, Saks OFF 5TH, and Under Armour.

Mastercard Travel & Lifestyle Services: Apple Card customers can access Mastercard’s exclusive travel and lifestyle benefits, including free nights at partner hotels, staycation offers, car and RV rental savings and status upgrades, personal airport concierge services, and more.

Priceless Experiences®: You get access to lasting memories, such as golfing with a pro player, taking virtual cooking classes with a celebrity chef, and enjoying online fitness and lifestyle lessons.

Priceless Golf: Apple Card customers who are Mastercard World or World Elite cardholders can access the TPC Network of clubs, book travel packages to bucket-list golf destinations, attend golf schools, and secure tee times through the Hidden Network of private courses. Additionally, they can enjoy Honorary Observer and Pro-Am positions at select PGA TOUR events.

How is an Apple Savings account different from a regular Apple Card?

One of the main differences between the Apple Savings account and the regular Apple Card is that there is no credit check required to open a savings account, thus it will not your cibil score. In fact, the only time a credit check is necessary is when you apply for the Apple Card, which is a prerequisite for accessing the savings account anyway.

Once you have set up your Savings account, you will automatically earn interest on your Daily Cash rewards. This means that every time you make a purchase using your Apple Card, you will receive a certain amount of cashback called Daily Cash. By setting up your Savings account, you can grow your Daily Cash rewards by earning interest on them. You can also earn interest on any additional funds that you deposit into your Savings account from a linked external bank account or your Apple Cash balance.

Another key difference is that there are no fees or minimum balance requirements with the Apple Savings account. This makes it easy and accessible for anyone to start saving money with their Apple Card. Plus, you have the flexibility to change your Daily Cash destination at any time or withdraw your funds without incurring any fees.

FAQs

What are Apple Savings Bank CD rates?

Apple Savings Bank CD rate (Certificate of Deposit Rate) is currently 4.15 percent, which is significantly higher than the national average.

What is the interest rate for Apple Savings Account?

Apple Savings Account offers an APY (Annual Percentage Yield) of 4.15%, which is more than 10 times the national average for savings accounts. The high-yield rate is made possible through a partnership with Goldman Sachs, a well-known financial institution.

Is Apple Savings Account FDIC-insured?

Yes, the Apple Savings Account is FDIC-insured, which means that the funds deposited into the account are backed by the full faith and credit of the US government, up to a maximum of $250,000 per depositor, per insured bank.

Which iOS versions are supported for Apple Savings Account?

Any iPhone with iOS 16.4 and beyond are compatible with Apple Savings Account.